ESG Commitment

At Elite Holding, our commitment to sustainability and responsible investing is grounded in action — not aspiration alone. Ambitions such as achieving net-zero carbon emissions must be supported by a coherent strategy, measurable targets, and transparent reporting.

The journey toward sustainability requires rigorous analysis of climate-related risks, evolving regulatory landscapes, and long-term investment impacts. Our ESG program reflects this understanding and continues to evolve as we refine our frameworks and expand our capabilities.

Our Responsible Investing Framework

Our Beliefs — The Why

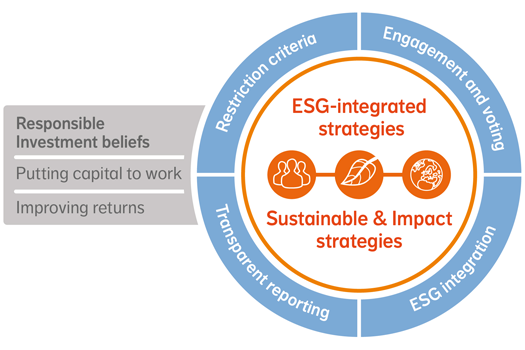

Our approach begins with two core beliefs:

Putting Capital to Work

We believe that responsible capital allocation is not merely about risk avoidance — it is about actively directing resources toward enterprises and projects that generate sustainable economic value. By integrating ESG considerations into our investment process, we seek to support businesses that are positioned for long-term resilience and growth while contributing positively to society and the environment.

Improving Returns

We are convinced that strong ESG practices are a driver of superior risk-adjusted returns over time. Companies that manage environmental, social, and governance factors effectively tend to exhibit more stable earnings, lower cost of capital, and greater operational efficiency. Our integration of ESG analysis is designed to enhance — not compromise — financial performance.

Our Approach — The How

Our ESG program is built around four key pillars:

Restriction Criteria

We apply responsible investing standards to exclude activities linked to controversial conduct. Our criteria align with our values, applicable laws, and internationally recognized frameworks such as the United Nations Global Compact and the OECD Guidelines for Multinational Enterprises.

Engagement & Voting

We engage with companies on behalf of our clients to drive sustainable corporate behaviour and enhance long-term value. Guided by internationally recognized standards, we focus on material ESG topics where we can positively influence outcomes. Through collaboration and active dialogue, we seek to drive measurable change.

ESG Integration

We integrate environmental, social, and governance factors throughout our investment process. Our approach goes beyond box-ticking — we identify, assess, and integrate material ESG risks and opportunities to strengthen decision-making and long-term performance.

Transparent Reporting

Transparent reporting is central to our responsible investing approach. We provide clear, comprehensive ESG disclosures to help clients understand exposures, performance metrics, and the impact of our engagement activities.

Responsible Investment Strategies

Our responsible investment strategies are structured across three tiers, each with increasing levels of ESG commitment and intentionality:

ESG Integrated Strategies

Systematic incorporation of environmental, social, and governance factors into traditional financial analysis and investment decisions across all asset classes.

Sustainable Strategies

Investment approaches that explicitly target measurable sustainability outcomes alongside financial returns, aligned with recognized frameworks such as the UN SDGs.

Impact-Oriented Strategies

Dedicated allocation to investments that seek to generate positive, measurable social and environmental impact as a primary objective, with financial returns as a complementary goal.

This tiered approach enables us to serve a broad spectrum of client preferences while maintaining consistency in our ESG principles and investment discipline.

Our Responsible Investing Framework

Elite Holding applies a clear set of restriction criteria to exclude investments in sectors or activities that are fundamentally misaligned with our values and sustainability objectives. These restrictions are reviewed and updated regularly to reflect evolving standards and stakeholder expectations.

Our exclusion policies cover areas such as controversial weapons, tobacco production, thermal coal extraction, and other activities that pose significant and unmitigable ESG risks. We believe that establishing clear boundaries strengthens portfolio integrity and signals our commitment to responsible stewardship.

Business Plans

Fostering a Cultural Shift

Embedding ESG into the fabric of our organization requires more than policies and processes — it demands a genuine cultural shift. At Elite Holding, we are committed to cultivating an environment where sustainability thinking becomes second nature in every decision we make. We encourage every team member to consider the broader implications of their work and to challenge conventional assumptions through a sustainability lens.

- "How does this decision affect our environmental commitments?"

- "Are we considering the social implications across all stakeholders?"

- "Does this align with our governance principles and long-term vision?"

Net-Zero & Climate Strategy

Elite Holding recognizes the urgency of the climate crisis and is committed to aligning its portfolio and operations with a net-zero emissions trajectory. Our climate strategy is informed by science-based methodologies and built on the following principles:

- Setting clear, science-aligned emissions reduction targets.

- Measuring and disclosing carbon footprint across Scope 1, 2, and 3 emissions.

- Engaging with portfolio companies to drive decarbonization.

- Investing in climate solutions and transition technologies.

- Advocating for supportive climate policy and regulation

Environmental Stewardship

- Implementing energy-efficient building standards across offices

- Minimizing paper usage and transitioning to digital workflows

- Promoting recycling and waste reduction programs

- Reducing business travel through digital-first communication policies

- Sourcing sustainable materials for office operations

- Encouraging sustainable commuting options for employees

Renewable Energy Initiatives

Elite Holding actively supports the transition to clean energy through targeted investments in renewable energy projects and by adopting renewable energy solutions within our own operations. We believe that accelerating the deployment of solar, wind, and other clean energy technologies is essential to achieving global climate targets and unlocking long-term economic value.